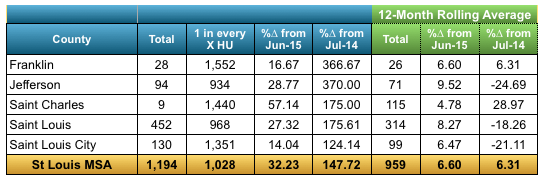

Flipping houses, something that went from something a few professional speculators only did years ago when I was actively buying homes for resale, became somewhat of a national pastime during the real estate boom years in the 2000 – 2007 period. House flipping in St Louis, while being done less than 10 years ago at nearly the peak of the bubble market, is still alive and well in St Louis. As the table below shows, during 2015 there were 2,386 homes flipped in the St Louis metro area, just about the same exact number as there were in 2014.

For the purposes of this article, a property that is sold, in an arms-length sale, for the second time within a 12-month period is considered a home flip.

St Charles County saw decline in house flipping…

As the data below illustrates, St Charles county was the only county in the St Louis core market that saw a decline in house flipping during 2015 from the year before and Franklin county saw the largest increase.

Gross profit on flips..

The second table down, shows the median gross profit, as well as return on investment (ROI) for house flips during 2015 by county.

(We work hard on this and sure would appreciate a “Like”)

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Want to flip property? Check out my video on how to buy foreclosures here. Continue reading “House Flipping Activity In St Louis Last Year Same As Year Before“